How Legacy Modernization in Banks Prevents Outages During Peak Loads?

Legacy modernization in banks boosts scalability, prevents outages, strengthens resilience, and ensures uninterrupted peak-hour performance.

Read Story

As the financial services industry becomes increasingly digital and client expectations evolve, many advisory firms are realizing the limitations of legacy CRMs like Redtail. In 2025, a growing number of financial advisors across the US and Europe are transitioning to more scalable, secure, and customizable platforms — with Salesforce Financial Services Cloud emerging as the clear frontrunner.

If your firm is planning a Redtail to Salesforce migration, this guide will help you understand the key benefits, process steps, compliance considerations, and tools involved in ensuring a seamless transition. Whether you’re a registered investment advisor (RIA), a wealth management consultancy, or an enterprise firm, our Salesforce migration services are designed to eliminate risk and maximize long-term value.

Redtail has long been a popular CRM for independent advisors and small to mid-sized wealth management firms. However, as firms grow and regulatory demands increase, Redtail’s limited scalability, automation, and integration capabilities become constraints.

Here’s why many firms are choosing Salesforce as their next-gen CRM:

Salesforce Financial Services Cloud offers tailored features for client relationship tracking, householding, financial goals, and regulatory recordkeeping — far beyond what Redtail provides.

Check out our complete guide on Salesforce Data Migration for Enterprise in 2025.

Features

Redtail CRM

Salesforce Financial Services Cloud

Automation

Basic workflows

Advanced process builder & flows

Compliance Support

Limited

FINRA, SEC, GDPR-ready

Integrations

Moderate (some third-party)

Extensive AppExchange ecosystem

Data Modeling

Basic fields and activities

Customizable objects and relationships

Scalability

Small to mid-size firms

Firms of all sizes, globally

Reporting & Analytics

Limited

AI-powered dashboards & reporting

Support

Email/phone

Enterprise-grade SLAs & support options

Investing in professional Salesforce migration services is critical for firms that can’t afford data loss, downtime, or compliance gaps. Here's why:

If you're considering whether to migrate internally or hire experts, keep in mind that a botched Redtail to Salesforce migration can lead to operational disruption, data breaches, and reduced advisor productivity.

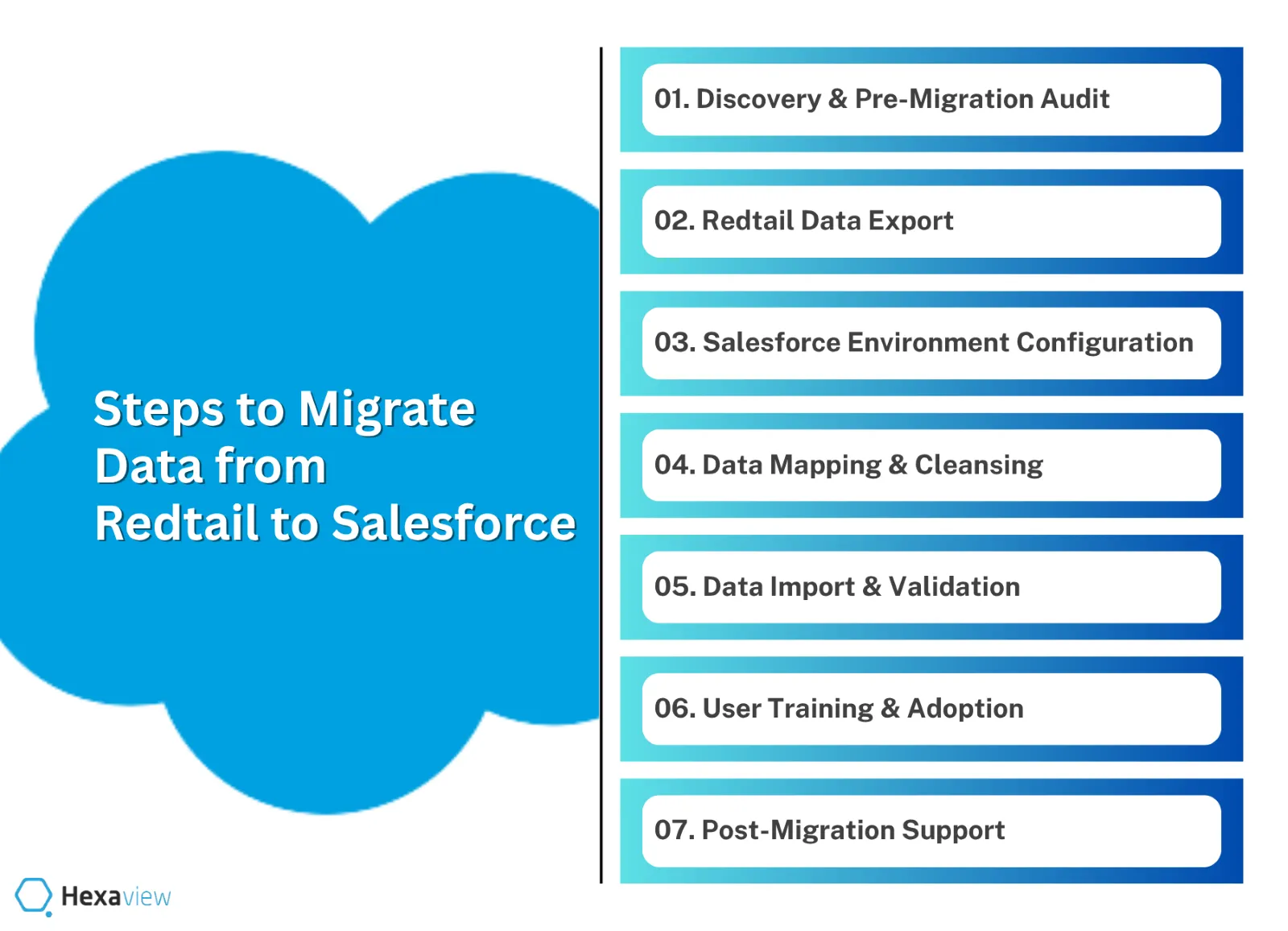

A smooth Redtail to Salesforce migration requires careful planning, structured execution, and testing. Here's a proven 7-step process our team uses to deliver high-impact Salesforce data migration services:

Redtail allows you to export client data in standard CSV or structured formats. For guidance, refer to their official Salesforce Implementation Guide which outlines available export options and best practices.

Key data types exported from Redtail include:

Before importing data, set up your Salesforce instance:

Data fields from Redtail must be mapped to Salesforce objects. This involves:

For specifics on how Redtail data aligns with Salesforce, consult Redtail’s Salesforce Data Sync Mapping Standard. This ensures your Salesforce data migration services accurately reflect your existing CRM.

Use tools like:

Once data is imported:

While the benefits are clear, the migration process also comes with risks. Here are common challenges and how to solve them:

Challenges

Solutions

Incomplete field mapping

Pre-migration mock runs and field auditing

Data duplication

Use deduplication tools or scripts

Loss of activity notes or history

Validate data mapping to custom Salesforce objects

Compliance gaps

Configure secure field-level access and audit logs

User resistance

Involve advisors early in the process and customize dashboards

Phase

Timeline (Approximate)

CRM Assessment

1-2 weeks

Migration Planning

1 week

Data Extraction & Mapping

2-3 weeks

Salesforce Configuration

2 weeks

Data Import & Testing

1-2 weeks

Go-Live & Optimization

Ongoing

Background: A 15-advisor RIA firm in California needed advanced automation, GDPR compliance, and integration with their portfolio tools.

Solutions:

Results:

In 2025, data-driven and compliant advisory firms are growing faster than ever — and legacy CRMs like Redtail are increasingly holding them back. Migrating to Salesforce gives you the flexibility, automation, and compliance framework you need to scale confidently.

If you're ready to upgrade, our expert-led Salesforce migration services are here to help you make the switch — without disruption, without data loss, and without guesswork.

A typical Redtail to Salesforce migration takes 4 to 8 weeks, depending on the size and complexity of your CRM data, the number of integrations, and compliance requirements. For smaller advisory firms with clean data and limited integrations, the migration from Redtail to Salesforce may be complete in as little as 2–4 weeks. Larger firms with complex workflows, third-party tools (e.g., portfolio platforms, e-signature solutions), and compliance customization may require 6–8 weeks for thorough testing and user adoption. A phased approach is often recommended to minimize business disruption.

You can migrate all core Redtail CRM to Salesforce CRM data, including:

Some legacy data formats may require transformation or re-mapping to Salesforce’s data model. We ensure your client history, compliance documentation, and relationship data migrate intact with our Salesforce data migration services.

Redtail’s basic workflow automations don’t transfer directly but can be recreated and enhanced in Salesforce. Salesforce Financial Services Cloud offers:

Our Salesforce migration services’ team helps rebuild your essential Redtail automations while optimizing them to leverage Salesforce’s advanced automation capabilities.

Yes, our Salesforce migration services follow strict compliance protocols for financial services. We implement:

Additionally, Salesforce itself is SOC 2, ISO 27001, and GDPR-compliant, making it a trusted platform for secure data storage and management.

We follow a proven multi-step validation process in all Salesforce data migration services:

This approach minimizes the risk of data loss or corruption.

You can continue using Redtail during most of the migration preparation phase, including audits and sandbox testing. A brief read-only period (typically a few hours a day) is recommended during the final data migration and cutover phase to prevent changes from being missed. Our team helps schedule downtime during low-activity periods (e.g., weekends or evenings) to minimize business impact.

Salesforce has a robust AppExchange ecosystem and supports native or third-party integrations with:

We configure these integrations during or after your Salesforce migration services project to create a unified tech stack post Redtail CRM to Salesforce CRM migration.

We provide end-to-end Salesforce adoption support, including:

This ensures your team feels confident and productive using Salesforce from day one.

While DIY migration may seem cost-effective, financial firms risk:

A professional salesforce migration partner mitigates these risks with proven processes, compliance expertise, and financial services industry knowledge.

Costs of Salesforce Migration Services vary based on:

On average, small to mid-sized advisory firms can expect $15,000–$40,000 for a full-service migration, with larger enterprise firms budgeting higher for complex environments. We provide customized quotes based on your needs.

%201.svg)

%201.svg)

%201.svg)

Helping regulated enterprises modernize systems, adopt AI-first engineering, and deliver outcomes that pass audits the first time.