Fintech

Binding seamless Technology with Finance

General Published on: Fri Feb 10 2023

Robo-Advisors has almost been a decade penetrated the Wealth Management sector, and they continue to proliferate deeper, even more disruptively. In just 10 years, they have attracted investors and are estimated to be managing around $20 billions currently. The industry primarily focuses on Portfolio management and is most common in the USA, apart from its presence in other continents. The main reasons for this prompt acceptance of Robo-Advisors as an industry could be the lower fee, transparent or pre-decided payment policies, and the ease with which the service could be obtained online, saving the hassle of meeting a financial advisor.

On the other hand, client profiling has always been an integral part of the Wealth Management industry and generally one of the planning process’s initial actions. The client profiler helps estimate the needs and wants of an investor and analyses the inputs given in a questionnaire, which forms a base for further analysis for the advisor.

So primarily, in both the scenarios, the Investors are required to answer a set of questions pre-decided with the utmost care by experts to gauge the correct preferences.

So, what is the difference?

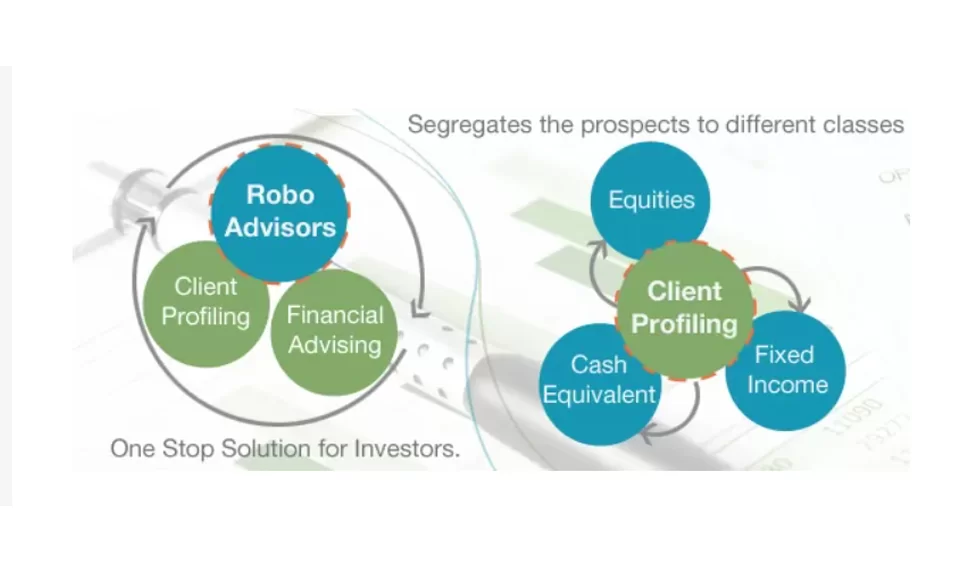

Although there is this fundamental similarity, the Robo-advisors can provide consultations and advice autonomously. They perform independently and combine both client profiling and financial advising elements, thus becoming a complete, exhaustive solution in itself. It is a comprehensive One-stop-solution for any investor, which is fast catching up and annexing more market share. The success of Robo-Advisors can be attributed to the intelligently automated advanced algorithms inbuilt in the software. Simultaneously, the client profiler remains to be used only for the primitive task of segregating the prospects to different classes.

Is there any way the Client Profiler can survive & grow?

Probably yes. Generally, inventions and products become archaic and irrelevant when there are no enhancements and improvisations. However, if it takes a cue from the Robo-Advisors and intelligence factors are added, for example, features for advanced and more complex data summarization and analytics for compound problems, there is still a long way to go.

But, if things stay the way they are, we feel Client Profiler would soon become redundant, and the usage will drop significantly. The investors or even the financial advisors might soon prefer using Robo-Advisors, which provide an extra level of output with the same input level from the client.

Get 30 Mins Free

Personalized Consultancy